Are Survival Times for Mesothelioma Improving? The Impacts of Improved Survival for Mesothelioma Patients on Recent California Cases

By James Scadden, Oakland, Richard Ames, Oakland and Dorothea Galdo, Oakland on September 20, 2023

The anticipated period of survival for a patient after a diagnosis of mesothelioma is of great significance in any mesothelioma lawsuit. Beyond the significance to the patients themselves, a predicted short life expectancy can dramatically impact the pace of litigation. For example, cases in California and Illinois may receive a “preference” or “expedited” trial date to accelerate litigation when the plaintiff can produce evidence raising substantial medical doubt that the plaintiff is unlikely to live more than six months. It has long been assumed that the prognosis for all mesothelioma patients is dire, even more so for pleural mesothelioma than peritoneal mesothelioma, but there is evidence that a significant percentage of mesothelioma patients live longer than 12 to 21 months from diagnosis.

Trends of Increased Survival for Mesothelioma Patients

The prognosis for mesothelioma patients varies by the location of the cancer, the cell type of the cancer, and the “stage” assigned to the cancer. The general statement is that life expectancy is between 12 and 21 months. Patients with peritoneal mesotheliomas tend to do better, and with surgery, they often have life expectancies greater than five to seven years.

The American Cancer Society approaches the issue differently by discussing the likelihood of achieving a five-year relative survival rate. Relying on surveillance, epidemiology, and end results (“SEER”) data, which tracks mesothelioma cases around the world, the American Cancer Society says only 12 percent of all cases have five-year relative survival rates. [1] However, the same data showed that for mesotheliomas that were considered “localized, ” the prognosis was the best with 24 percent of those cases having a five-year relative survival rate.[2]

A 2022 epidemiological analysis revealed a stable overall incidence of malignant peritoneal mesothelioma (“MPM”) but improved recognition of epithelioid histology. [3] Survival improved over time and was associated with cancer-directed surgery, suggesting that accurate diagnosis of epithelioid histology, or tissue and skin cancer, may lead to more patients being considered for appropriate multimodal treatment and contribute to improved overall survival. Although the overall age-adjusted incidence of MPM remained stable from 2000 to 2018, there has been an increase in cancer-directed surgery and a concurrent improvement in MPM survival over time. This contemporary analysis of MPM survival reflects trends after the increased adoption of effective therapies for MPM, including cytoreductive surgery (“CRS”) and hypothermic intraperitoneal chemotherapy (“HIPEC”).

Other research has also analyzed how the number of mesotheliomas among men and women has changed in the decades since asbestos regulations came into effect in the 1970s. These analyses have all shown much more significant declines in cases among males, while incidences among females have remained relatively stable. [4]

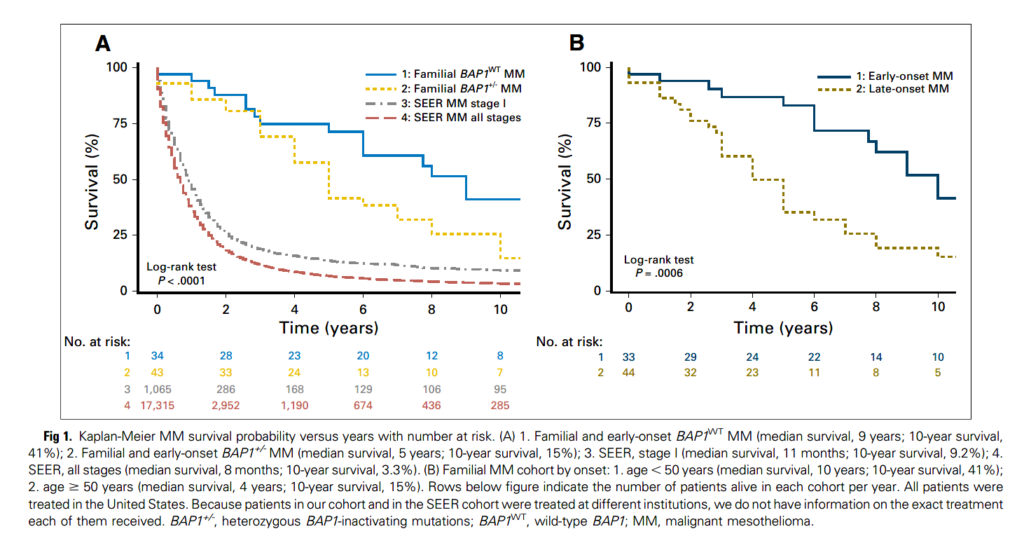

Physicians continue to develop their understanding and differential diagnoses of mesotheliomas and have found that some peritoneal mesothelioma patients have life expectancies more than five years after treatment, depending on the particular cell type and origin of disease. In one study of 164 female patients with peritoneal mesothelioma, 85.3 percent lived more than five years after treatment![5] Other studies have made preliminary showings that patients with a BAP1-related mesothelioma can have a much longer survival rate of five to seven years for the median, with 26 percent of patients living more than 10 years. This is much longer than the average of 11 months reported in the international SEER database.[6]

Much of the research and scientific study on mesothelioma patients is affected by the monetary value of a case in which the plaintiff is alleged to have a terminal, incurable illness. This monetary influence is even affecting the decisions of treating doctors not directly involved in the litigation. Even though genetic testing is “standard practice,” some patients are being advised by their oncologists to seek information about the genetic component of their mesotheliomas through research studies or decline testing altogether to keep this information out of their litigation.[7]

Long-term Survival of Mesothelioma Plaintiffs in Recent California Cases

The case of “Decedent A” is particularly notable. In 2010, Decedent A filed a personal injury–asbestos action after being diagnosed with peritoneal mesothelioma in 2009. Decedent A moved for a preference trial date asserting that their survival beyond six months was unlikely. The court granted a preference trial date within three months after Decedent’s motion was heard, and litigation pursued.

However, Decedent A survived for 12 years and passed away in 2021. Decedent A’s 2009 diagnosis was made without the benefit of more recent diagnostic and therapeutic tools. Decedent’s death certificate asserted the immediate causes of death were coronary artery disease, atrial flutter, congestive heart failure, and peripheral artery disease. Mesothelioma and Type 2 Diabetes were additionally named as other significant conditions in Decedent’s death. Decedent’s heir has now filed a wrongful death action.

“Plaintiff L” is also a long-term mesothelioma survivor. Plaintiff L was diagnosed with pleural mesothelioma in January 2021. Since their diagnosis, Plaintiff L has filed two separate asbestos personal injury actions. The first lawsuit was filed in May 2021. Similar to Decedent A, Plaintiff L also moved for a preference trial date due to their medical condition. The court granted Plaintiff’s motion, and ultimately this lawsuit resolved at trial.

It has been two years since Plaintiff L’s mesothelioma diagnosis. In fact, Plaintiff L has recently filed a second separate personal injury lawsuit for the same disease but has now named different defendants. Unlike their first lawsuit, there is no preference trial motion pending. The court has taken notice that the “expert” declarations submitted in Plaintiff L’s first lawsuit moving for preference have been shown to be unduly pessimistic in regard to Plaintiff L’s survival.

As survival rates for peritoneal mesothelioma patients continue to increase, it is clear that the landscape of asbestos litigation will also develop. As seen with Decedent A, although medical evidence was presented to support the court’s finding for an expeditious trial date, they lived far beyond the assumed six months. With Plaintiff L, their increased survival allowed them the opportunity to bring a second separate lawsuit against different defendants but may have also barred them from seeking a second potential preference trial date. In many of our cases, the defense bar is continuing to resist requests for preference trial dates with some success. As more instances are reported of cases involving survival well beyond the oft-quoted rates, perhaps there will be more such successes in the future.

[1] Survival Rates for Malignant Mesothelioma | American Cancer Society <https://www.cancer.org/cancer/types/malignant-mesothelioma/detection-diagnosis-staging/survival-statistics.html>

[2] Id.

[3] Calthorpe, et al. 2022, Contemporary Trends in Malignant Peritoneal Mesothelioma: Incidence and Survival in the United States, Cancers 2023, 15, 229.

[4] Price 2022, Projection of future numbers of mesothelioma cases in the US and the increasing prevalence of background cases: an update based on SEER data for 1975 through 2018, Critical Reviews in Toxicology, 52:4, 317-32

[5] Malpica 2022, Peritoneal Mesothelioma – An Update, Adv. Anatomic Pathology 2022; Malipca et al. 2021, Malignant mesothelioma of the peritoneum in women: a clinicopathologic study of 164 cases Am. J. Surg. Pathol. 2021: 45-48.

[6] Pastorino S, Yoshikawa Y, Pass HI, et al: A subset of mesotheliomas with improved survival occurring in carriers of BAP1 and other germline mutations. J Clin. Oncol 36:3485-3494, 2018. See also Carbone M, Pass HI, Ak G, et al: Medical and surgical care of patients with mesothelioma and their relatives carrying germline BAP1 mutations. J Thorac Oncol 17:873-889, 2022.

[7] Hathaway 2023, Family Matters: Germline Testing in Thoracic Cancers, American Society of Clinical Oncology Educational Book.